The Trend of Global Industrial Mergers and Acquisitions

Deloitte & Touche Co., Ltd. recently released its "Prospects for Mergers and Acquisitions in Globalized Industrial Industries in 2019" report, which predicts that the number of mergers and acquisitions in chemical industry will decline slightly in 2019 due to uncertainty, rising interest rates, trade tensions and slowing global economic growth, but the market of mergers and acquisitions in chemical industry will remain vibrant.

1. In 2018, the quantity of chemical mergers and acquisitions decreased and the price increased

According to the report, the number of mergers and acquisitions in the global industrial sector in 2018 was 600, down 5% (637) from 2017, the lowest level since 2014. After a weak performance in the first quarter of 2018, the number of global mergers and acquisitions of workers increased continuously in the following three quarters, and this positive momentum continued in 2019.

However, the amount of M&A in the chemical industry in 2018 was $72.4 billion, significantly higher than that of $46.4 billion in 2017, and still lower than that of $145.8 billion in 2015 and $231.1 billion in 2016.

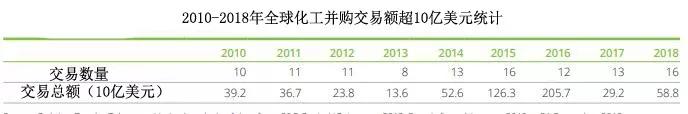

In 2018, the number and amount of large-scale M&As in the chemical industry exceeded 1 billion US dollars, which were 16 and 58.8 billion US dollars, respectively, higher than 13 in 2017 and 29.2 billion US dollars respectively.

From the point of view of subdivision plate, the bulk chemical products sector accounts for the largest proportion, with 348 mergers and acquisitions, which is lower than 387 in 2017; the number of specialty chemicals decreased from 172 in 2017 to 157; the number of fertilizer and agricultural chemicals sector mergers and acquisitions increased from 65 in the previous year to 77.

2. Maintaining stability in M&A of large chemical companies

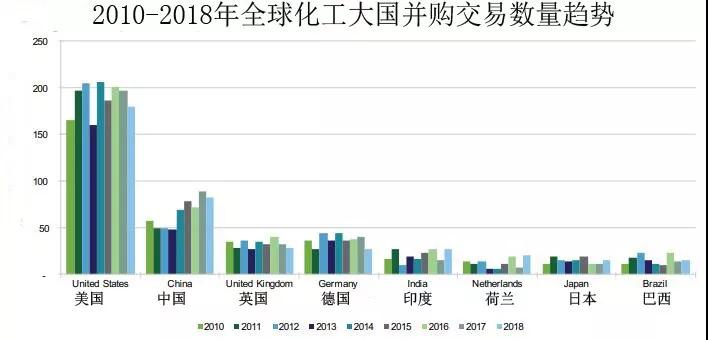

In 2018, M&A activities of chemical industry in major countries remained stable. Among the major countries, the number of mergers and acquisitions in the chemical industry of the United States, China, the United Kingdom and Germany declined, while the number of mergers and acquisitions in India, the Netherlands, Japan and Brazil increased in 2018.

China: The total amount of M&A transactions in the chemical industry disclosed in 2018 was US$14.3 billion, which was higher than US$8.5 billion in 2017. In 2019, the increasing integration of domestic bulk chemical products, fertilizers and agrochemical sectors may be the characteristics of M&A in China's chemical industry.

US: Although the volume of trading declined slightly compared with 2017, the activity in 2018 remained healthy. Trading volume in 2019 is expected to be the same as in the past two years.

Germany: M&A activity declined slightly in quantity and value in 2018. Major participants declared poor financial conditions, so they were cautious about the outlook for 2019.

India: The industry is expected to continue to witness M&A growth led by the basic chemicals, agrochemicals and construction chemicals sectors.

Netherlands: 2018 was a record year for chemical mergers and acquisitions in the Netherlands, with a value of $14.7 billion, the highest in 10 years.

UK: In 2018, companies from continental Europe were particularly active in the UK market, with Belgium, Germany, Italy, Sweden and Switzerland accounting for about a third. Uncertainty about decoupling from Europe is affecting the investment climate in Europe, which in turn affects consumer confidence.

Japan: Although some manufacturers'incomes declined, the Japanese chemical industry performed well in 2018. M&A intentions have been high and are expected to remain vibrant in 2019.

3. The M&A market will remain vibrant in 2019

The report predicts that mergers and acquisitions in the global industrial sector will decline moderately in 2019, but buyers with sufficient cash on hand, relatively low credit costs and a desire to bring higher returns to investors will keep the basic conditions for mergers and acquisitions strong.

Global economic growth has been downgraded & trade protectionism in developed economies has risen

Global economic growth has been downgraded, and industrial production in many economies is under pressure, and industrial production is one of the main drivers of demand for chemical products. This will make the decision-making level of enterprises questionable about the radical process of capital distribution in 2019 and the timing of launching large-scale cross-border mergers and acquisitions.

According to the report, trade protectionism is on the rise in many developed economies, and Global trade tensions and protectionism will also stop business decision makers from considering mergers and acquisitions.

In the next few years, an important trend worthy of attention is the impact of digitalization and circular economy on the chemical industry. Enterprises with highly diversified business have already utilized digitalization technology in many fields. Mergers and acquisitions will remain one of the tools for enterprises to maintain competitiveness and promote transformation.

Although recycling economy may not have been a driving factor for industry M&A in the past, the report says that initiatives on plastic waste disposal may be the starting point for companies to invest in and acquire technology for this purpose.

4. M&A of China's chemical industry will still focus on China

In China, the total amount of M&A transactions in the chemical industry disclosed in 2018 was US$14.3 billion, higher than US$8.5 billion in 2017. The amount of M&A of foreign-funded enterprises to Chinese chemical enterprises is only US$200 million. The M&A of Chinese enterprises to overseas chemical enterprises continues to be limited due to their concern for the domestic market.

According to the report, in 2018, Chinese buyers'enthusiasm for mergers and acquisitions of large chemical enterprises significantly weakened, with the number of related mergers and acquisitions declining by 14%. In 2019, China's chemical industry market will face challenges due to the dominance of state-owned enterprises and the high price demanded by private enterprises. However, with the rising demand for processed foods and the rapid growth of China's food and beverage industry, foreign mergers and acquisitions in the areas of Chinese food additives, animal nutrients and active drug ingredients (API) are likely to increase.

According to the report, the EU and the United States are strictly censoring the mergers and acquisitions of Chinese enterprises for the reasons of protecting their own technology. The mergers and acquisitions of Chinese chemical enterprises in the United States will decline, and the foreign mergers and acquisitions of Chinese chemical enterprises may turn to South America, Southeast Asia and the Middle East.

Deloitte believes that the increasing integration of large-scale chemical products, fertilizers and agrochemical sectors in China in 2019 may be the characteristics of M&A in China's chemical industry, due to the increasing supervision of environmental protection and safety by the Chinese government, rising operating costs and fiercer domestic competition.